The Cash Clarity Method™

Controller-grade cash clarity for Odoo clients, built to show how your money actually moved.

Available exclusively for Odoo clients — built to give founders real visibility without forecasts, dashboards, or fluff.

Sometimes the numbers look fine — tidy Profit and Loss, sharp dashboards, solid-looking revenue — yet something still feels off. You’re not sure where the money actually went, whether things are getting tighter, or if you’re still on steady ground.

GAAP-based financials and most dashboards weren’t designed to show detailed cash movement. They’re great for compliance and storytelling, but not always for clarity — especially for founders running the business, not just reporting on it.

If your books are reconciled but decisions still feel uncertain, the issue probably isn’t the numbers — it’s the structure. The Cash Clarity Method™ changes that by turning reconciled books into a cash-based system that shows what actually happened. Built for operators — not just accountants.

Not forecasting or advisory. Just clean, controller-grade systems and answers grounded in reality.

Scope

The Cash Clarity Method™ is an optional add-on for Odoo clients, built during the Implementation & Onboarding phase (hourly) and then maintained as part of the monthly cycle. It offers a cash-based lens on operational activity — helping identify spending patterns, vendor shifts, and signs of financial pressure that may be missed in standard reports.

Updated monthly after each accounting close is completed, the Cash Clarity Method reconstructs actual cash activity using reconciled Odoo data to deliver a decision-ready view of movement, trends, and a cash runway estimate based solely on historical cash activity — all without relying on forecasts, assumptions, or non-cash logic.

Each tab serves a specific purpose:

-

Executive Summary – Highlights key movements and directional trends in plain English

-

Visuals – Charts spending patterns and potential timing pressure

-

Formulaic Runway – Trailing Runway – Shows how long cash would last if recent spending patterns continued, based only on historical data (not a forecast).

-

Monthly Splits – Breaks down activity by grouping, vendor, bank, or Analytic Account

-

Account Splits – Categorizes activity by account type with subtotals

-

Drilldown – Enables filtered, transaction-level review for internal validation

-

Pivot Table – Supports flexible, self-serve analysis for advanced users

Comparisons

Generally Accepted Accounting Principles (GAAP) are the standardized accounting rules all CPAs and accountants follow. While the Cash Clarity Method™ is a proprietary, internal cash-focused insights system — built from reconciled GAAP books to give founders operational clarity.

Core Purpose | Generally Accepted Accounting Principles | Cash Clarity Method™ |

|---|---|---|

Accrual-based performance view | ✅ | ❌ |

Identifying vendor/client spend shifts | ❌ | ✅ |

Comparison between companies | ✅ | ❌ |

Real cash movement visibility | ❌ | ✅ |

External compliance & audits | ✅ | ❌ |

Month-end cash clarity for operators | ❌ | ✅ |

Long-term performance view | ✅ | ❌ |

Cash-based operational management | ❌ | ✅ |

Storytelling for investors/lenders | ✅ | ❌ |

Pricing

-

The Cash Clarity Method™ is billed hourly as part of the Implementation & Onboarding phase, then transitions into a fixed monthly retainer once the system is stable.

-

Implementation typically spans 9–12 months and is structured as a monthly retainer with hourly overage for discovery, cleanup, policy work, rebuilds, and system design.

-

Exact scope and timelines depend on system condition, documentation quality, and historical reliability, but most clients plan for a structured year-long stabilization window before transitioning into recurring services.

-

Once stabilized, services move to a fixed monthly structure for ongoing reporting and oversight.

If implementation isn’t viable:

All work performed is billed. You’ll always be invoiced for hours already completed, whether you continue with the Cash Clarity Method™ or decide to exit.

Within 30 days of determining it’s not viable, you can:

-

Continue onboarding hourly — I’ll simply remove the Cash Clarity Method™ from your ongoing monthly services.

-

Disengage completely — termination fee–free, with no additional charges beyond payment for work already performed.

Universal Disclosures

No one loves reading disclosures — but they’re what keep everyone aligned, protected, and clear.

Because transparency is core to how I operate, I’ve consolidated nearly all system-wide disclosures here so the rest of this webpage can focus on tab-specific details only.

If new disclosures are added directly to the Cash Clarity Method workbook and this webpage is not yet updated, those workbook disclosures take precedence.

-

The Cash Clarity Method is not a substitute for GAAP financial statements or formal attestation services. It provides supplemental, controller-grade insights based on reconciled accounting data.

-

Outputs are based entirely on past reconciled data — no forecasting, no projections, no assumptions.

-

Inputs are provided by the client or their bookkeeper via their Odoo file. I review for material accuracy and post adjustments as needed. Once closed, outputs reflect my best understanding based on the reconciled data available.

-

Two files are used: one internal workbook maintained by me (not shared), and one client-facing file updated monthly. The structure of both is my intellectual property.

-

Refunds on vendor bills and customer payments are applied using a simplified logic due to system limitations in Odoo. Allocations may not perfectly reflect the original account splits but are restricted to the accounts in the original transaction.

-

This is a standalone Excel-based system, built and maintained during Implementation & Onboarding (hourly) and carried forward into the monthly cycle.

-

This is for internal management use only — not for investors, funding, or regulatory decisions.

-

Final responsibility for interpretation and use rests with management.

Having clarity gives you

insights you can build upon.

It saves you from guesswork & gives you peace of mind.

One system, built for clarity — so you can trust what you see and act without hesitation.

Executive Summary

When time’s tight and decisions can’t wait — this is where you look first.

You don’t always need a deep dive to spot what’s shifting. Sometimes you just need a clear pulse — one that tells you what changed, where the cash went, and whether you’re still on steady ground. That’s what this tab is built for.

The Executive Summary tab condenses key insights from across the Cash Clarity Method™ into one readout: estimated runway, month-over-month cash shifts, top vendor movements, and quick-hit commentary on revenue, COGS, and OpEx. Every number is pulled from actual cash activity — not projections, not forecasts — and automatically updates based on the date you select.

Every insight is written in clear, plain-English sentences designed for founders — no accounting jargon, no guesswork. You’ll know what changed, what drove it, and how it compares to last month or last year — all at a glance.

This isn’t about reporting for reporting’s sake. It’s about giving you a high-signal snapshot of where things stand, so you can spot risks early, see progress faster, and move with confidence.

What’s Included

-

Net Cash Change Runway and Operating Cash Outflows Runway estimates both based on trailing cash activity

-

Ending bank balance for the selected period

-

Month-over-month cash movement and change analysis

-

Year-over-year cash comparison and variance

-

Revenue trends vs prior month and prior year

-

Largest shifts in cost of goods sold and operating expenses (account level)

-

Top 3 account level changes (by dollar or percentage)

-

Simple estimated runway extension calculator based on current Net Cash Change

Excutive Summary Specific Disclosures

-

Runway estimates are illustrative only, based on trailing actual cash activity, and are not predictive. All figures, including runway calculations, are formula-driven with no manual overrides or professional judgment applied. For methodology, see the Formulaic Runway section.

-

Any reported spikes or drops should be reviewed in full context.

The below screenshots are from sample data and not live data.

The screenshots below use sample data, not live data.

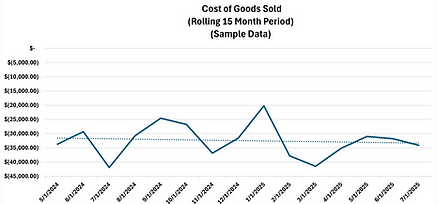

Visuals

Sometimes the numbers are technically there — but the picture still doesn’t click.

Your reports might list every transaction, sort by vendor, even reconcile to the bank. But when you're trying to spot trends, seasonality, or sudden shifts, reading through raw rows rarely gets you there. It’s like staring at a dense paragraph when what you need is a headline.

That’s what the Visuals tab is built for.

Not to replace the structure — but to surface what it's already telling you. It’s a visual overlay on clean, controller-grade data, designed to help your brain process it faster. Whether you're looking for month-to-month cash outflows, vendor trends, or which category drained the most this quarter, this tab turns movement into signal.

There’s no fluff here — just real, reconciled cash movement mapped across the views founders ask for most. And because it’s all formula-driven off the Historical Data tab, there’s zero guesswork. Just scroll, scan, and spot what matters.

What’s Included

-

Ending Bank Balance (15-month trend)

-

Customer Receipts (15-month trend)

-

Cost of Goods Sold (15-month trend)

-

Operational Expenses (15-month trend)

-

Cash Outflows by Category – Last Month

-

Cash Outflows by Category – Quarter to Date

-

Cash Outflows by Category – Year to Date

-

Cash Outflows by Category – 15-Month Total

Visuals Specific Disclosures

-

All graphs are automated from reconciled cash data — no manual overrides

-

Trends are illustrative and may shift as historical data is updated

Formulaic Runway

How long can we keep this up?

It’s one of the most important questions a founder can ask — but the hardest to answer when you’re deep in daily operations. Sales are moving, vendors are being paid, the bank balance looks decent — and yet it’s not clear whether the business is stabilizing or slowly bleeding out. That’s where the Formulaic Runway tab comes in. Instead of forecasting, it uses a trailing average (weighted or simple) to estimate how long the current pace of spending and receipts could be sustained — then frames it as: “If nothing changes — how long will the cash last?” While not a forecast, it can help surface directional shifts earlier — especially when reviewed consistently over time.

The tab gives you two perspectives:

• Operating Cash Outflows Runway: This strips out inflows to stress test how long operations could fund themselves with no new cash coming in.

• Net Cash Change Runway: This includes all movement — operational spend, customer receipts, even financing — to show the average months remaining at the current full pace.

Both calculations use trailing averages based on selectable timeframes (3, 6, 9, 12, or 15 months). Each average can be set to simple or weighted, depending on user selection. Both are fully formula-driven. And both serve the same goal: Clarity on whether the current pace is sustainable — or quietly accelerating toward a cliff.

What’s Included

This tab estimates how many months of cash remain based on recent spend trends. It’s meant to give high-level visibility — not predict the future. No assumptions, no modeling — just clean math off real, reconciled cash movement.

To do that, it calculates two separate trailing estimates, each showing a different lens on spend pace. Both are based on a trailing weighted or simple averages over a selected period of time and are 100% formula-driven — with no GAAP logic, accrual timing, or manual inputs.

-

Operating Cash Outflows Runway

-

Goal: Estimate how long operations could self-fund if all inflows stopped, based on trailing spend pace.

-

What It Represents: A stress test of true operating spend — ignores all inflows (customer, investor, etc.).

-

What's Included: Weighted or Simple Average of the past [3,6,9,12,15] months of COGS + OpEx + G&A.

-

-

Net Cash Change Runway

-

Goal: Estimate how many months of cash remain at current trailing inflow/outflow pace.

-

What It Represents: Tracks net movement of total cash — includes all inflows and outflows

-

What's Included: Weighted or Simple Average of the past [3,6,9,12,15] months of total net cash change (COGS, OpEx, Investor funding, customer receipts, etc.).

-

Formulaic Runway Specific Disclosures

-

This report is non-GAAP and based entirely on actual, reconciled cash movement.

-

Results are based on a trailing average (3,6,9,12,15 months).

-

All metrics are 100% formulaic, derived from reconciled past data thus there is no smoothing, and no manual overrides.

-

No forecasting, no projections, modeling, or assumptions are applied.

- These metrics are for internal pacing awareness only — not for investor updates, funding models, or formal reporting.

-

All calculations rely on the fully reconciled Historical Data tab. Inaccurate or incomplete bookkeeping will affect results.

-

All weighted percentages are derived automatically through built-in formulas.

The screenshots below use sample data, not live data.

Monthly Splits

You know the numbers add up — but sometimes the story still feels incomplete.

The totals reconcile, the bank accounts match, and everything appears in order — yet the flow of money doesn’t sit right. It’s not that the data is wrong; it’s that you’re looking at it through a single, fixed angle. Shift the lens, and those same numbers can reveal patterns you couldn’t see before — patterns that make movement clearer and easier to interpret.

The Monthly Splits tab gives you that shift. It reshapes reconciled cash activity into a month-by-month breakdown, filtered through whichever view matters most — a specific vendor, a single bank account, or an analytic account in Odoo. The underlying totals never change; what changes is how they’re organized. By presenting the same data in a different structure, trends become easier to follow, outliers stand out faster, and the flow of cash is easier to confirm. The goal isn’t to reinterpret the numbers — it’s to make them easier to see, understand, and act on.

What’s Included

Totals per split selected, with beginning and ending balances shown for each month

A monthly breakdown of reconciled cash activity, based on your selected split:

- Analytic Account Name (if enabled in your Odoo file)

Bank / Credit Card Name

Groupings

Vendor / Customer Name

Monthly Splits Specific Disclosures

Analytic Account split may return blank if not configured in Odoo

Totals are tied directly to the Historical Data tab to ensure completeness, consistency, and auditability with no overrides.

If all company card activity is recorded under a single credit card account in Odoo without separate journal types or GL accounts for each cardholder, individual card names cannot be identified because that detail is not present in the source data.

The screenshots below use sample data, not live data.

Account Splits

This is where structure meets substance.

Every insight in the model comes from somewhere — and this tab shows you exactly where. The Account Splits tab is the foundation: a clean, categorized view of actual cash movement, mapped to the chart of accounts you already use. Nothing here is modeled, forecasted, or smoothed. Just real cash activity, sorted into familiar financial structures.

Each section organizes cash movement into clear account groups — Receipts, Cost of Goods Sold, Operating Expenses, Balance Sheet activity, and more. You can see both the category totals and the account-level detail beneath them, with figures matching the Historical Data tab exactly. That consistency makes this a dependable reference whenever something looks off.

It’s also the go-to when a number in the Visuals, Executive Summary, or Formulaic Runway tabs doesn’t add up. The Account Splits view traces every total back to its original account, so every amount is both visible and verifiable — making it faster to confirm accuracy and make course corrections when needed.

What’s Included

Monthly cash activity organized by your chart of accounts

Category-level groupings (e.g. Receipts, COGS, OpEx, etc.) with full account-level detail beneath each

Subtotals by section, aligned to the Historical Data tab

Beginning and ending cash balances per month

Monthly movement summaries — Net Cash Change and Operating Cash Outflows (see Formulaic Runway section for details)

Account Splits Specific Disclosures

This tab is not GAAP-compliant and does not follow formal presentation standards, even if some groupings resemble a P&L or cash flow structure

Customer receipt logic is determined by account-level posting behavior and may vary in presentation based on how revenue is recorded.

Section totals reconcile directly to the Historical Data tab to preserve auditability and consistency

The screenshots below use sample data, not live data.

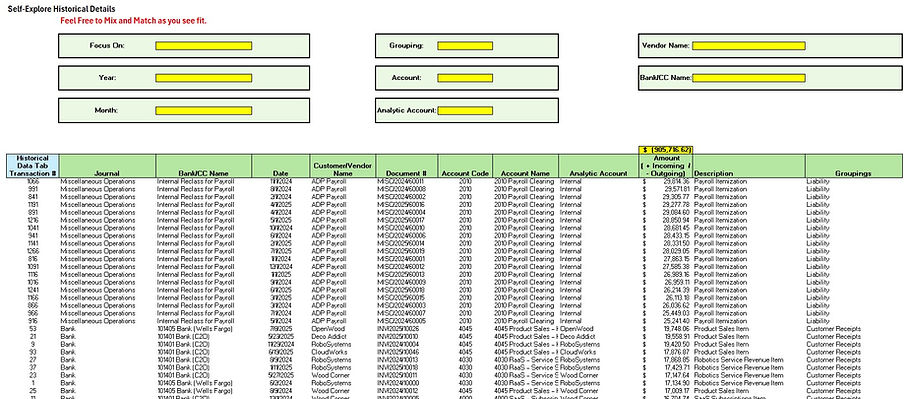

Drilldown

Self-Explore Historical Details

This tab provides a full view of reconciled cash activity at the transaction level, with filters to focus on the details that matter most. Up to eight filter options are available so you can narrow down results to match your specific query. The goal isn’t to interpret the data, but to make it searchable, sortable, and transparent whenever a deeper look is needed.

To make analysis easier, the tab includes two identical drilldown tables that function independently. This allows for side-by-side comparisons using different filter sets, so you can review activity across vendors, months, or internal categories without losing your place. Filters can be adjusted at any time, and the underlying data updates automatically to reflect matching entries.

What’s Included

Two independently controlled drilldown tables for side-by-side analysis

Full transaction-level visibility based on reconciled cash activity

Direct linkback to categorized data from the monthly close (via Document # column)

Live filtering across any combination of fields (Mix & Match):

Focus On – limits the view to top/bottom transactions or largest changes by dollar amount (e.g., Top 10, Largest 5 Changes, etc.)

Year

Month

Grouping

Account

Analytic Account

Customer / Vendor Name

Bank / Credit Card Name

Drilldown Disclosures

No additional disclosures apply to this tab beyond the universal disclaimers above.

The screenshot below uses sample data, not live data.

Pivot

This tab exists for power users who want to explore the categorized data freely. It doesn't contain any formulas, commentary, or analysis — just a live pivot table tied to the same monthly transaction set already shown in the primary views.

The layout is dynamic. Users can toggle filters or expand/collapse row groupings to customize how they view activity. While the default is grouped by department and account, this structure can be easily modified using standard Excel pivot tools.

This is not a required tab for understanding the Cash Clarity Method™ outputs — it’s simply included for those who prefer alternate ways of working with numbers.

What’s Included

Pivot table built on categorized transaction detail

Default structure:

Rows grouped by Department and Account Name

Values shown as Net Amount (+ Inflows / – Outflows)

Ability to:

Expand/collapse row groups

Reorganize data as you see fit

Sort and/or filter as you see fit

Export or copy views as needed

Pivot Specific Disclosures

No additional disclosures apply to this tab beyond the universal disclaimers above.

The screenshot below uses sample data, not live data.

Build Structure That Frees You.

I’ve designed this system for founders who want clean, consistent financials and the confidence to make decisions without second-guessing.

———

If that’s what you’re building toward, I’m here.